Share the page

Our economic model

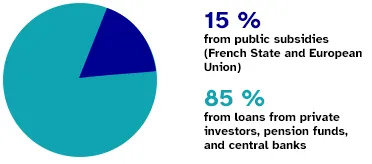

AFD is first and foremost a public bank, and finances itself mainly by borrowing on the markets, made possible by the financial stability of its sole shareholder: the French State.

Considerable budgetary leverage

Where AFD's financial resources come from:

85% of AFD’s operations consist of loans to partner countries, while grants are only allocated in the most critical situations to prevent crises and promote international stability.

A simple business model with a multiplier effect

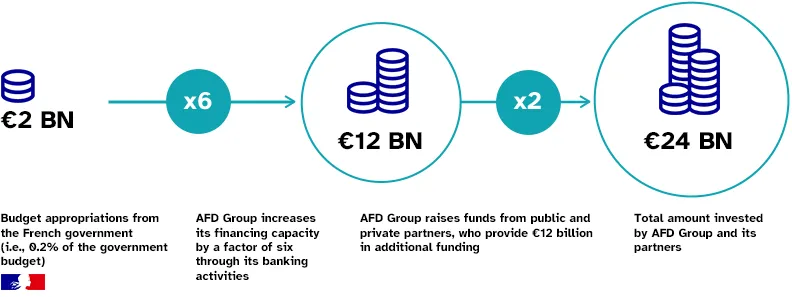

AFD has significant leverage as an efficient and cost-effective public bank. It is able to turn €2 billion in government budget appropriations into a financing capacity of €12 and €13 billion each year. An additional €12 billion is provided through public and private co-financing, bringing the annual total to almost €25 billion. In other words, for every €1 invested by the French government, nearly €12 goes to addressing global priorities such as combating climate change, preserving biodiversity, and supporting public health, education, and food security.

This business model generates significant development impacts. Our business plan thus involves targeting operations according to their degree of impact, with AFD Group ensuring that these results are measured over time.