Share the page

AFD successfully issued a new 2 billion US dollars bond maturing on February 4, 2031

Published on

On Wednesday 28th January 2026, Agence française de développement (AFD), rated A+ (Stable) by S&P and A+ (Stable) by Fitch, successfully issued a new 2 billion US dollars bond maturing on February 4th, 2031.

This new deal is AFD’s second public transaction this year, following its last €2bn 10-year sustainable bond executed on Tuesday 20th of January 2026.

Thibaut Makarovsky, Head of Funding and Market Operations at AFD: “This transaction, completed after a one-year absence, successfully marks our return to the dollar market - a strategic market for AFD as a source of diversification. The record size in terms of demand and high quality of the order book reflect the strong enthusiasm of USD investors for our signature. We warmly thank them for their trust.”

Transaction highlights:

The USD 2 billion transaction offers a final spread of 67 bps over the SOFR Mid-Swap curve, equating to an annual re-offer yield of 4.247% and a re-offer price of 99.456%, with a coupon of 4.125%.

The transaction met strong interest from the outset with a wide and diverse range of quality investors registering their interest with a final book above USD 12.4bn (including JLM interest).

Execution and allocations:

The transaction was announced to the market at 2.00pm CET on Tuesday 27th January with IPTs released at SOFR MS+70bps area.

Indications of Interest were in excess of USD 4.1bn+ (including USD 150m JLM interest) when the book opened on Wednesday morning at 09.18am CET, with a Guidance refined at SOFR MS+68bps area (+/- 1) will price in range.

On the back of a rapidly increasing orderbook with quality building up during the morning, reaching USD 7.5bn+ (including USD 300m JLM interest) at 10.50am CET, AFD managed to fix the final spread at the tight end of the Guidance at MS+67bps, while maintaining the “benchmark” language.

The strong momentum continued post tightening, and by 12.10pm CET investor demand surpassed USD 12.3bn (including USD 300m JLM interest), enabling AFD to set the size at USD 2bn.

The transaction priced at 3.35pm CET with a coupon of 4.125% and a final yield of 4.247%, which translated in a re-offer price of 99.456%.

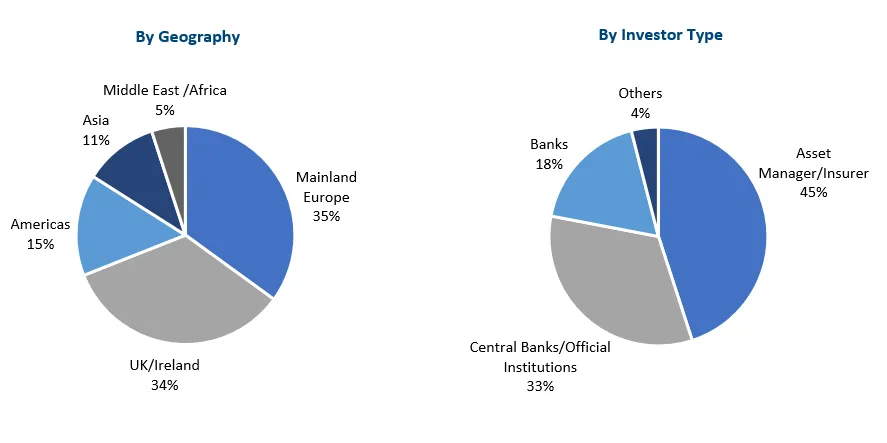

The quality of the order book is reflected in the typology of investors allocated: asset managers and insurances were allocated 45% of the final size, central banks & official institutions 33%, banks 18%, and finally 4% were allocated to other investors. In terms of geographies, Mainland Europe accounts amounted to 35% of allocations, followed by UK & Ireland investors with 34%, Americas with 15%, Asia with 11% and Middle East /Africa with 5%.

Transaction details:

- Issuer: Agence française de développement

- Ratings: A+ Stable (S&P) / A+ Stable (Fitch)

- Transaction Size: USD$ 2 billion

- Issuing Date: January 28th, 2026

- Settlement Date: February 4th, 2026

- Maturity Date: February 4th, 2031

- Re-offer Price: 99.456%

- Coupon: 4.125% Fixed, Semi-annual, 30/360

- Annual Re-offer Yield: 4.247%

- Final Spread: 67 basis points

- Listing: Euronext Paris

- Joint Lead Managers: Barclays, Citi, CACIB, HSBC, Morgan Stanley

Investor Distribution: