Share the page

AFD Successfully issued their first benchmark of the year, a new €2 billion sustainable bond maturing on January 28th 2036

Published on

Being a Sustainable issuance, the proceeds of the bond will be used to finance/refinance a portfolio of loans that meet the criteria defined in the group’s SDG bond issuance framework.

Transaction highlights:

- On Tuesday, January 20th, 2026, Agence française de développement (AFD), rated A+ (S&P)/ A+ (Fitch), successfully issued a new EUR 2 billion sustainable bond maturing on January 28th, 2036.

- The €2 billion transaction offers a final spread of +27 basis points over the OAT curve, equating to an annual re-offer yield of 3.846% and a re-offer price of 99.215%, with a coupon of 3.750%.

- The orderbook closed in excess of EUR 8.4bn with quality accounts, making it AFD’s second largest ever orderbook after their EUR 10y 2bn transaction from 2021.

- Despite a very volatile start to the year in the French political scene, with the French Prime minister Lecornu deciding to invoke Article 49.3 yesterday to pass the French budget, AFD achieved a very strong outcome and were able to navigate a busy market.

- This transaction represents AFD’s first benchmark of the year, with a funding programme of €9bn estimated for 2026.

Thibaut Makarovsky, Head of Financing and Market Operations at AFD: “This transaction marks a strong return on the primary market for AFD. The EUR 10-year issuance is a major trade for us, allowing to gather a strong diversity of investors. The orderbook, above EUR 8bn – the second biggest ever for AFD, demonstrates this support, and we are thankful for their trust. Issuing a sustainable bond is also the opportunity to reiterate our commitment, as a Group, to SDGs. We will be announcing our 2026 program at the end of January”.

Execution and allocations:

On Monday 19th January 2026 at 12:55 CET, AFD announced a mandate for a new EUR 10y Sustainable benchmark to be launched in the near future. Following constructive investor feedback, AFD officially opened the orderbook the following day at 9:00 CET with guidance released at OAT+30bps area. The book grew rapidly from the outset reaching over EUR 7bn (incl. EUR 500m JLM) at 10:36 CET, enabling AFD to set the spread 3 basis points tighter from guidance to OAT+27bps. The orderbook closed at 11:15 CET in excess of EUR 8.4bn (incl. EUR 500m JLM) composed of quality accounts, allowing AFD to set the issue size to EUR 2bn. The transaction subsequently priced at 14:03 CET, with a coupon of 3.750% and a final yield of 3.846% which translated in a re-offer price of 99.215%.

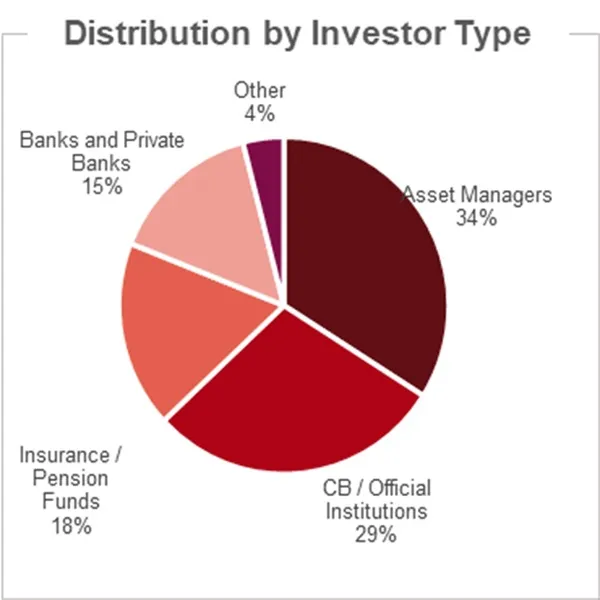

The quality of the orderbook is reflected in the typology of investors allocated:

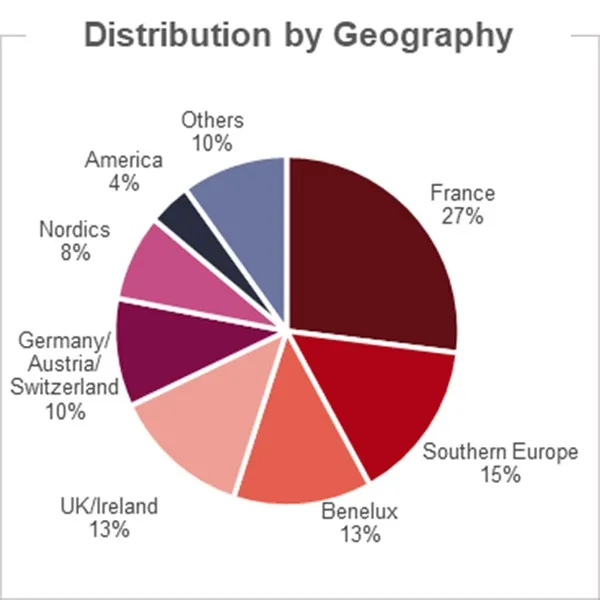

Regarding the geography:

Transactions details :

• Issuer: Agence française de développement

• Ratings: A+ (S&P, stable) / A+ (Fitch, stable)

• Transaction Size: EUR€ 2 billion

• Issuing Date: January 20th, 2026

• Settlement Date: January 28th, 2026

• Maturity Date: January 28th, 2036

• Re-offer Price: 99.215%

• Coupon: 3.750%, annual Act/Act ICMA

• Annual Re-offer Yield: 3.846%

• Final Spread: 27 basis points

• Listing: Euronext Paris

• Joint Lead Managers: BNP Paribas, BofA Securities, J.P. Morgan, Natixis, Société Générale