Share the page

Improving Access to Agriculture Financing in Tanzania

Project

-

Project start date

-

Status

Ongoing

-

Project duration

-

5 years

-

AFD financing amount

-

€ 81 000 000

-

Location

-

Tanzania

-

Type of financing

-

Beneficiaries

-

Tanzanian Agricultural Development Bank (TADB)

This project aims at improving access to financing for small holder farmers in Tanzania through a credit line provided to TADB.

Context

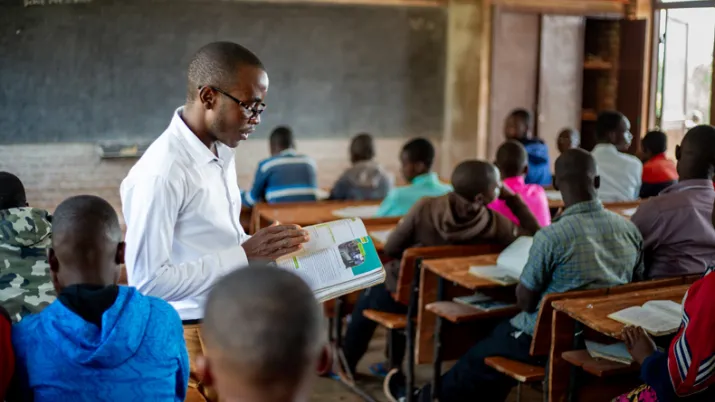

Agriculture contributes to about 30% of Tanzania’s GDP, 30 % of export earnings and 2/3 of national employment. Although smallholder farmers represent 15 million people and cultivate 90 % of the land, there is limited financing available to agriculture in Tanzania.

Financial institutions are usually reluctant to financing this sector due to the high costs associated with serving a predominantly rural clientele. In addition, borrowers generally lack appropriate collaterals and banks have to follow prudential guidelines that are not fully conducive for agriculture lending.

To address these financing challenges, the Government of Tanzania decided to create an Agricultural Development Financial Institution to support transformation towards sustainable food security and self-sufficiency by providing short, medium to long-term financing to the agricultural sector.

Through TADB, the Government aims at directly supporting large projects mainly in infrastructure development for irrigation, storage and transport.

Description

The mission of the project is to provide innovative financial solutions to ensure that Tanzania’s food security is sustainable and self-sufficient.

The line of credit will not only enable the co-financing of projects with partner financial institutions, but also give these institutions access to concessional financial resources, enabling them to lend at preferential rates to small-scale farmers.

- The funds will also be used for the Smallholder Credit Guarantee Scheme (SCGS) to incentivize Tanzanian financial institutions to focus lending on smallholder farmers.

- Finally, a Technical Assistance program will support the partner financial institutions and their clients to design and implement efficient and sustainable agricultural projects.

Impacts

The project has several objectives:

- Strengthen the operational capacities as well as the governance of the bank.

- Contribute to the sustainability of TADB and allow it to best fulfill its mandate. The project is expected to promote climate smart agriculture and better agricultural practices with a sustainable use of resources.

- Promote financial inclusion: at least 80% of the loans disbursed by TADB and PFIs will target smallholder farmers and rural microenterprises as direct loan beneficiaries.

- Promote gender equality and youth inclusion: At least 20% of the loan amounts will be directed to women and youth, smallholder farmers or rural microenterprises (below 35 years old). Specific financial products will be developed for promoting gender equality in intermediation activities and digital finance with a specific approach to women and youth.