Share the page

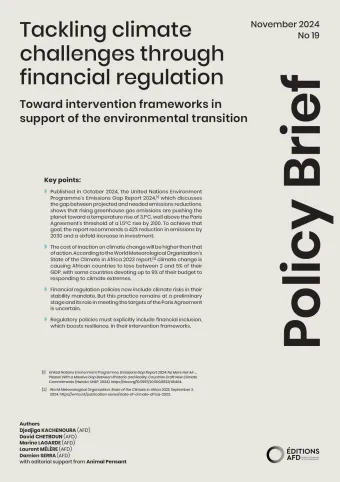

Tackling climate challenges through financial regulation

Published on

In 2015, in the run-up to COP21 in Paris, the speech by Mark Carney, then Governor of the Bank of England and mandated by the G20's Financial Stability Board, made history. He warned of the importance of financial climate risks for the stability of financial institutions and the financial system as a whole. The political burden of transition was left to governments, provided it was orderly, while the responsibility for stability fell to regulators and central banks. Finance”, informed by extra-financial disclosure regimes, would drive demand as a provider of capital. These disclosure regimes were to be initiated by private players and supported by regulators. Mr. Carney feared, however, that they would lack coherence, comparability and clarity. Since then, these schemes have proliferated, covering both risks and the alignment of financial flows with the Paris Agreement. Nevertheless, this “theory of change” and the division of responsibilities between players remain unclear and ambiguous. Financial regulators need to work together to make these different regimes interoperable and clarify their objectives. What's more, compliance costs and the disconnection of certain frameworks from national realities are holding back the mobilization of funding, and may lead to the exclusion of the most vulnerable entities, a subject that has received little attention.

Useful Information

-

Authors

-

David CHETBOUN, Marine LAGARDE, Laurent MÉLÈRE, Damien SERRA, Djedjiga Kachenoura

-

Edition

-

19

-

Number of pages

-

4

-

ISSN

-

2742-5312

-

Collection

-

Policy Brief

-

Other languages