As part of this research project, AFD is working with the Biotope/Arcadis consortium to identify the best methods for measuring biodiversity – or "biodiversity metrics" – for Public Development Banks (PDBs). This project aims to strengthen the mainstreaming of biodiversity criteria into financing decisions, thereby contributing to a more nature-positive economy.

As part of this research project, AFD is working with the Biotope/Arcadis consortium to identify the best methods for measuring biodiversity – or "biodiversity metrics" – for Public Development Banks (PDBs). This project aims to strengthen the mainstreaming of biodiversity criteria into financing decisions, thereby contributing to a more nature-positive economy.

Context

Today, the loss of biodiversity has become a major risk for financial systems. In September 2023, Ravi Menon, Chairman of the NGFS – the network of central banks, financial regulators and financial institutions for the greening of the financial system – warned: "Along with the climate crisis, the degradation of nature is an existential threat facing our planet. Addressing nature-related risks and its broader implications for the financial sector is no longer just prudent – it is an imperative".

As these risks require rigorous measurement, several frameworks have been proposed. The NGFS has published a conceptual framework for taking into account the risks associated with biodiversity loss. Target 15 of the Kunming Montreal Global Biodiversity Framework also encourages businesses and financial institutions to assess, report on and reduce the risks associated with biodiversity loss and the negative impacts they have by 2030. Lastly, the Task Force on nature-related Financial Disclosure (TNFD) has proposed a reporting framework to help businesses and financial institutions analyse and disclose these risks and impacts, recommending the use of various biodiversity metrics.

However, as the missions of PDBs focused on achieving the Sustainable Development Goals (SDGs) are very specific within financial institutions, there are few studies to help this type of institution identify the biodiversity metrics best suited to their activities.

Objectives

The main objective is to compare six biodiversity metrics to determine which are best suited to the needs of Public Development Banks. By identifying the best practices, this project aims to guide PDBs in their financing decisions, by better integrating biodiversity considerations. This harmonisation of biodiversity measurement practices will improve the environmental impact of the projects financed.

The research project also seeks to reveal the accessibility costs and the need for training within PDBs so that they can effectively integrate biodiversity considerations into their risk assessments.

This project is part of the ECOPRONAT research programme, which supports research on how to better take into account biodiversity and mainstream it into key economic sectors.

Method

Following an preliminary comparative study by The Biodiversity Consultancy, six metrics for assessing biodiversity in PDBs projects were selected: ENCORE, ABC-map, STAR, CBF, BFFI and GBS. These relevant and scientific metrics cover the main drivers of biodiversity loss.

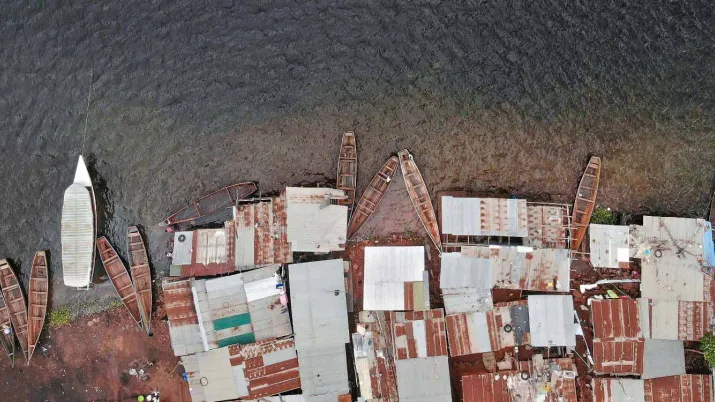

A sample of six varied AFD projects was selected to test these metrics. The projects include initiatives in Africa, Pakistan and Mexico. The European Bank for Reconstruction and Development (EBRD) also tested the same metrics on three of its projects.

The study, conducted by Biotope and Arcadis, is being carried out in three phases:

- Launch and data collection: briefing, project validation and data collection with recommendations;

- Implementation: summary assessment, then in-depth assessment depending on the data available;

- Consolidation and reporting: analysis of results, comparison of metrics and drafting of summary report.

Results

A preliminary study proposes several protocols for the use of several metrics in order to compare their results. It also contains information that may be useful to some development banks that simply want to choose a metric and see how they can use it. With this in mind, a decision tree for choosing one of the metrics studied is proposed in Appendix 2 of this preliminary report.

Download the preliminary study

This research project aims to produce a comparative analysis detailing the advantages and limitations of the different biodiversity metrics studied. A Public Policy Dialogue provides synthetic results, a case study and specific recommendations for the integration of these metrics into PDBs financing processes.

Download the Public Policy Dialogue

The full report will be published on this page after the Biodiversity COP16 by the end of 2024. In addition, webinars and publications will be used to share the findings with a wider audience, including development and biodiversity protection stakeholders.

Download the final Research paper N°381

Contact

-

Julien CALAS

Research Officer on Biodiversity

Discover other research projects

To what extent do carbon credits and voluntary carbon markets really contribute to the achievement of the objectives of the Paris Climate Agreement? By opening the "black box" of these instruments, this study proposes a critical analysis of the economic paradigm in which they fit and identifies ways to reconceptualize them through an environmental accounting framework.

To what extent do carbon credits and voluntary carbon markets really contribute to the achievement of the objectives of the Paris Climate Agreement? By opening the "black box" of these instruments, this study proposes a critical analysis of the economic paradigm in which they fit and identifies ways to reconceptualize them through an environmental accounting framework.

Context

Voluntary carbon markets (VCMs), created in 2000, are carbon credit trading mechanisms that allow companies, in particular, to voluntarily offset their carbon footprint. They can be traced back to the Kyoto Protocol, which introduced the principle of trading greenhouse gas emission reduction credits (or ‘CO2 equivalents’) in 1997. However, they are distinct from ‘carbon allowances’, which are part of a compliance scheme rather than a voluntary one.

These voluntary markets have grown significantly in recent years. One of the driving forces behind this development has been the implementation of initiatives to achieve ‘Net-Zero’ targets – the vast majority of which are voluntary, although some compliance mechanisms allow the use of carbon credits (e.g. the Corsia mechanism in the aviation sector). All this should contribute to the development of an ecosystem for trading the regulatory environmental service of carbon capture, in support of the objective of reducing consumption of the ‘global carbon budget’, itself set by the IPCC.

However, voluntary carbon markets have been the subject of criticism and controversy since their inception, and questions remain as to whether they will actually help to achieve the objectives of the Paris Agreements.

Goal

Based on an analysis of the existing situation and the conceptual framework that currently structures the voluntary carbon markets and carbon credits, the study identifies the pitfalls not only of these markets and their organisation, but also of the instruments traded and the underlying paradigms that validate the current structuring of these markets.

The aim is to put forward proposals to ensure that the realities of the climate and the available carbon budget are better integrated into the operation of voluntary carbon markets, so that they become genuine tools for helping companies to make the climate transition. For example, it answers fundamental questions such as: should I offset, what part and what volume of my emissions are legitimate for offsetting, should I contribute to maintaining climate regulation services without offsetting?

Method

Using an accounting and management approach, the study questions current approaches to voluntary carbon markets, centred on the neoclassical economic paradigm. It promotes a ‘climate debt’ approach, as well as the management of this ‘climate debt’ through carbon budgets to be managed by means of preservation activities whose primary function must be to reduce greenhouse gas (GHG) emissions.

Using an ecological accounting method, the study describes how companies should contribute to global climate debt reduction beyond the voluntary carbon markets, and, through their organisational processes, addresses the levels of accountability for the various emission sources (scopes 1, 2, 3).

Lessons learned

The study shows that carbon credits and voluntary carbon markets are disconnected from climate and organisational realities. Opening the ‘black box’ of VCMs shows that behind this name lie several conceptions of these instruments, and therefore several ways of using and accounting for them within companies. What's more, the tools used by companies are not linked to the objectives of national or international climate policies, so they cannot be used to steer progress towards a global low-carbon trajectory.

To reconnect these instruments with climate policies, these markets need to be thought outside the neoclassical conceptual framework that gave rise to the other carbon management tools. The study proposes principles for reorganising these markets around a ‘managerial’ approach (using in particular the C.A.R.E. ecological accounting and management framework). It makes it possible to design VCMs to ensure compliance with carbon budgets allocated between companies, based on the global carbon budget defined by the IPCC. It thus gives theoretical and operational meaning to the ‘avoid/reduce/compensate’ sequence and to the use of compensation for ‘residual emissions’.

In other words, in order to collectively stay below 1.5°C of global warming, companies would each have to respect a given carbon budget each year (the carbon credit not being a licence to pollute or an emission right, but rather an instrument to be included in a strategy to limit greenhouse gas emissions). This would make it possible to support businesses while reconnecting the tool (VCMs), businesses and climate policies, from the perspective of global governance of the climate system.

Find out more:

- Download the research paper (in French): Crédits carbone et marché carbone volontaire : analyse critique au regard des politiques climatiques et des sciences de gestion, et proposition d'un cadrage comptable écologique des crédits carbone

- Watch the research webinar (in French): Pertinence des marchés volontaires de carbone : aujourd'hui et dans un futur neutre en carbone