Share the page

Aiming for the SDGs: 10 Recommendations for Development Banks Around the World

Published on

AFD’s 14th International Development Research Conference, and the Finance in Common Summit were the occasion for an international network of researchers to offer initial recommendations for boosting the potential of public development banks, and for supporting structural transformations, which help pave the way to a fairer and more sustainable global economy.

Around the globe, we share huge concerns: climate change, degradation of nature and inequality. To deal with them, large-scale concerted action at all levels is needed. The challenge is to foster major structural transformations of all economies to not only increase their productivity, but also make them inclusive and low-carbon.

See also: The Finance in Common Summit, all our articles

Public development banks (PDBs) may operate on a local, national, continental, or international basis. Whatever the case, they are key instruments in helping governments finance rapid recovery from the Covid-19 crisis. PDBs are also important for long-term transformation of existing economic models, so that they work much better for people and the planet.

An initiative with 28 researchers from 20 institutions

It’s against this backdrop that the International Research Initiative on PDBs was created in 2019, initiated by the Institute of New Structural Economics (INSE) and supported by the International Development Finance Club (IDFC), Agence Française de Développement (AFD), and the Ford Foundation.

The initiative associates 28 researchers from 20 institutions around the world.

They include:

- INSE in China

- Columbia University and Boston University in the United States

- the Foundation for Studies and Research on International Development (FERDI)

- the Institute for Sustainable Development and International Relations (IDDRI) in France

- the Overseas Development Institute (ODI) in the United Kingdom

- the Department of Economic and Social Affairs (DESA)

- the United Nations Conference on Trade and Development (UNCTAD)

- the Brazilian Development Bank (BNDES) and the Minas Gerais Development Bank (BDMG)

“The International Research Initiative on PDBs brings together researchers from the world’s top universities,” says Stephany Griffith-Jones, an economist specializing in international finance and development at Columbia University and the University of Sussex.

“It focused on the search for the best business models and the changes needed in financial regulations to maximize their impact on development, as well as on the conditions for better governance,” added Griffith-Jones, who coordinated the initiative.

“It’s also studying how PDBs can channel financing as effectively as possible to make the economy more ecologically sustainable and fairer, as well as to help countries recover from the Covid-19 crisis.”

10 recommendations that Span Development Banking

The five open and theme-based working groups of the initiative covered the key challenges identified by Stephany Griffith-Jones, publishing a total of 16 research papers. Based on all their findings, Stephany Griffith-Jones, Régis Marodon (sustainable finance expert at AFD), and Jiajun Xu (professor at INSE) have written a summary that is now available with 10 key recommendations for decision-makers.

It’s an initial but decisive step toward better understanding PDBs. A new field of exploration is now opening up, this time based on a more systematic collection of data.

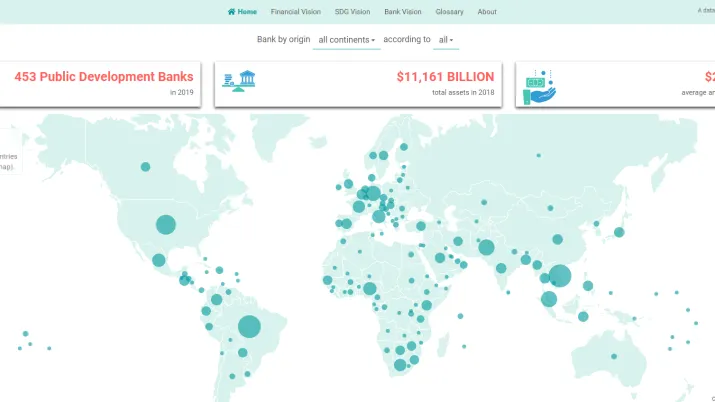

As Régis Marodon explains, “Data are important to back up facts with proof and to differentiate them from opinions. With PDBs, we were faced with a variety of opinions but very few figures. A database, now available in open source, now responds to this need and opens up new and exciting fields of research.”

See the detailed document: 10 strategic recommendations on public development banks, for decision-makers

Further reading

Public Development Banks: the First Global Database

Published on November 9, 2020

Finance in Common Summit: "A Coalition of Public Development Banks to Refocus the Financial System"

Published on October 27, 2020