Share the page

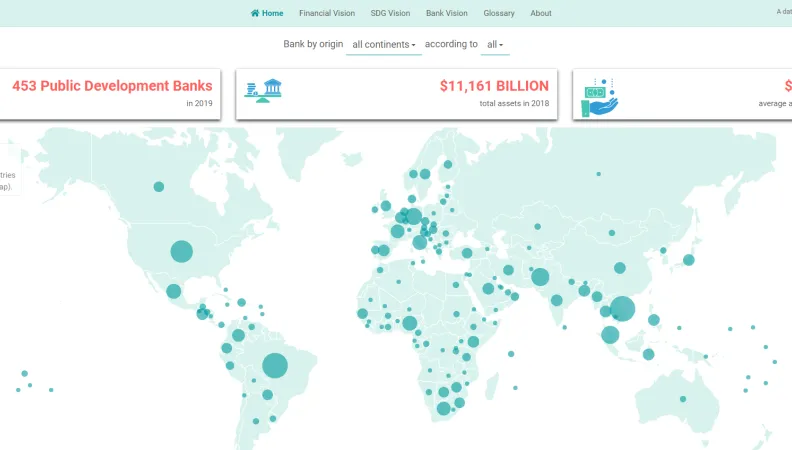

Public Development Banks: the First Global Database

Published on

What are development banks and finance institutions, and what is their purpose? What assets can they mobilize, and what is their share in the global financial market? The answers may surprise you. For the first time, a database provides a comprehensive mapping of development banks, and sheds light on the sheer might of these unsung institutions.

There are 450 public development banks (PDBs) around the world, on every continent. Though varying widely in size and specialization, they wield immense financial heft, with total assets standing at over $11 trillion. Yet despite their influence, people know little about the role they play or the impact they can have, and this is due in part to a lack of readily available data.

Further reading: All our articles on the Finance in Common Summit

To learn more about these key institutions, Peking University's Institute of New Structural Economics (INSE) and Agence Française de Développement (AFD) have developed the first exhaustive database on PDBs, using their annual reports. The initial results were presented on 9 November 2020 during AFD's 14th International Research Conference on Development, called “The Invisible Hand: Development Banks in Transition” and organized as part of the Finance in Common Summit.

Useful algorithms

At the same time, AFD is working on two algorithms. The first aims to automate financial data searches. The second is based on an algorithm created in partnership between AFD and the OECD SDG Financing Lab. It will highlight the consideration given to the Sustainable Development Goals (SDGs) by development banks.

This work is part of the research program “Realizing the Potential of Public Development Banks and Development Finance Institutions for Achieving the Sustainable Development Goals” launched by Peking University INSE and supported by AFD, the Ford Foundation and International Development Finance Club (IDFC).

Did you know:

- China Development Bank is the largest public development bank in the world: a balance sheet of $2.4 trillion, a capital of $189 billion, $19 billion of net income, roughly the same size as JP Morgan, the largest US bank in 2018.

- China’s five PDBs have a total of $4 trillion of assets, accounting for 35% of the world total.

- The PDBs of the 27 European Union countries, including their regional banks EIB and EBRD, have a total of $3.95 trillion of assets, an amount comparable to China’s PDBs. It is worth noting that Germany’s Landesbanken, the product of a savings collection and corporate finance system very specific to Germany, have a total of $1.2 trillion of assets (10% of the world total).

- Some banks are very small. The Roraima development institution in Brazil only has a balance sheet of $2 million. In 2018, Fundo Ganadero (agricultural bank of Paraguay that finances small-scale farmers) had a total balance sheet of only $18 million and a capital of $5 million. The development banks of the Pacific island States, such as Tuvalu, Niue and American Samoa, also have small balance sheets of a similar size.

- The oldest PDB is the Caisse des Dépôts et Consignations (France, 1816), followed by Banco de la Provincia de Buenos Aires (Argentina, 1822) and Casa de Depositi e Prestiti (Italy, 1850).

- The most recent were set up in 2019: International Development Finance, Corporation (US-IDFC), Banco del Bienestar (Mexico), Hellenic Development Bank (Greece), International Investment Bank of Guinea.

- The most emblematic: the European Investment Bank (EIB), a European regional bank with a balance sheet ($555 billion), profitability (net income of $2.3 billion, 2,900 employees), financial strength (rated AAA) and governance making it a world reference for sound management and effectiveness.

- Only 143 PDBs have a balance sheet above $3 billion. They account for 98% of the assets listed.

- 258 PDBs have a balance sheet below $1 billion, with a total of under 1% of global assets.

This calls for greater solidarity and cooperation among development banks, to allow them to grow and scale up, as long as they’re able to ensure good governance and garner adequate capitalization.

By the way, what is a public development bank?

We use the generic term of public development banks (PDBs) here to refer to all the financial institutions with a mandate to finance a public policy on behalf of the State. These mandates vary considerably, but they all contribute to the achievement of the Sustainable Development Goals (SDGs).

This term also includes international financial institutions, multilateral banks, housing finance companies, agricultural banks, housing banks and investment funds, as well as certain institutions that are not strictly speaking banks.

Public development banks is not a universal term. Depending on the country, institutions are sometimes referred to as “Development Finance Institutions (DFIs)”, “Policy Banks” or “Promotional Banks”. These are generally more specific sub-categories.

The first difficulty in estimating the number and financial weight of PDBs lies in identifying them as a community of similar institutions. It is not easy to group them together due to their widely ranging mandates, the reasons behind their creation, their areas of operation and their financial instruments.