Legal notice EU (project) What would be the impact of a carbon tax policy on poverty and inequality in Indonesia? How can we design effective policies that simultaneously meet environmental and distributive objectives? In partnership with LPEM, the EU-AFD Research Facility on Inequalities aims to adapt the CEQ Institute framework to understand the distributional impact of actual and potential carbon prices in Indonesia, as well as potential mitigation options.

Legal notice EU (project) What would be the impact of a carbon tax policy on poverty and inequality in Indonesia? How can we design effective policies that simultaneously meet environmental and distributive objectives? In partnership with LPEM, the EU-AFD Research Facility on Inequalities aims to adapt the CEQ Institute framework to understand the distributional impact of actual and potential carbon prices in Indonesia, as well as potential mitigation options.

Context

Indonesia’s commitment to carbon emission reduction is aligned with its global responsibilities under the Paris Agreement. The country is also one of the 52 national jurisdictions in the world that have established carbon pricing regulations (World Bank, 2023). The primary goal of carbon pricing instruments implementation is to support Indonesia in achieving its Nationally Determined Contribution – which are commitments that countries make to reduce their greenhouse gas emissions as part of climate change mitigation.

In this context, the Government of Indonesia intended to introduce carbon pricing instruments on a voluntary basis from 2021 to 2024, with a shift to mandatory enforcement expected by 2025. Despite its modest start, the introduction of this tax marks a considerable advancement in Indonesia, particularly given the few low and middle income countries that have implemented a carbon tax.

Using carbon pricing as a method to foster a decarbonised economy is a significant policy instrument, yet it can lead to uneven burdens across different societal groups. These measures, while environmentally beneficial, may inadvertently promote inequality. If these disparities are not addressed, the push towards global decarbonation could be hindered, achieving less impact or imposing uneven costs.

Using an analytical tool from Commitment to Equity Institute (CEQ Institute), this research project aims to improve the design of policies that can both deliver environmental goals whilst reducing the distribution burden, by ensuring a just transition.

This project is part of the Extension of the EU-AFD Research Facility on Inequalities. Coordinated by AFD and financed by the European Commission, the Extension of the Facility will contribute to the development of public policies aimed at reducing inequalities in four countries: South Africa, Mexico, Colombia and Indonesia over the period 2021-2025.

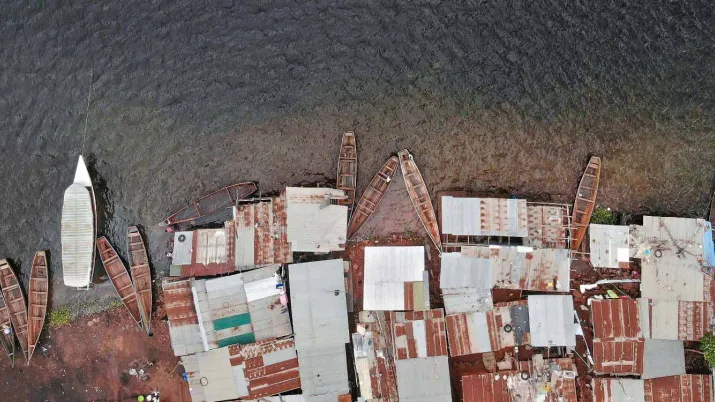

This research project complements two studies carried out by the EU-AFD Research Facility on Inequalities in collaboration with the Indonesian government on Marine Protected Areas development policies and the production of a diagnostic on inequalities in the country.

Objectives

The general objective of this research project is to assess the environmental (emission) and welfare-distributional effects (indicators of poverty and inequality) of trading and non-trading instruments (carbon price and revenue). Specifically, the study aims to incorporate heterogeneous cost and impact assessments across the archipelago of Indonesia.

The study will focus on the impact of carbon pricing and other indirect fiscal instruments (taxes and subsidies) combined with direct taxes and social transfers that can assist in the mitigation of these instruments on welfare distribution and environment.

Method

In order to design more effective policies that meet both environmental and distributive objectives, CEQ Institute has developed an analytical tool using micro data on household characteristics, behavioural science and a data analytical tool known as microsimulation modelling. It is an ex ante planning tool taking micro units, such as households, and simulating policy changes in advance of policy implementation.

The framework incorporates the following discrete analytical dimensions:

- Methodological frameworks to model the distributional impact of fuel related fiscal policies;

- An Input-Output framework to track the indirect impact of carbon prices;

- Behavioural implications of alternative environmental challenges using a demand system;

- Identifying just transition solutions using social protection instruments.

The dataset integrates two primary sources: the 2016 Table Input Output from the Central Bureau of Statistics (BPS) and the 2022 National Socioeconomic Survey (SUSENAS). Data and information from the Indonesian Directorate General of Taxes and from various relevant ministries are also used to conduct the study.

Research findings

The research paper related to this project is available for download here: Data Analytics for a Just Transition. Distributional Impacts of Environmental Policies (Indonesia)

The study concludes that the success of Indonesia’s energy transition will depend not only on its environmental effectiveness but also on its ability to ensure fairness across different segments of society.

For further information

Other research projects supported by the Extension in Indonesia

Harnessing the benefits of inequalities reduction in marine protected areas in Indonesia

Completed

2022 - 2023

As part of this research project, AFD is working with the Biotope/Arcadis consortium to identify the best methods for measuring biodiversity – or "biodiversity metrics" – for Public Development Banks (PDBs). This project aims to strengthen the mainstreaming of biodiversity criteria into financing decisions, thereby contributing to a more nature-positive economy.

As part of this research project, AFD is working with the Biotope/Arcadis consortium to identify the best methods for measuring biodiversity – or "biodiversity metrics" – for Public Development Banks (PDBs). This project aims to strengthen the mainstreaming of biodiversity criteria into financing decisions, thereby contributing to a more nature-positive economy.

Context

Today, the loss of biodiversity has become a major risk for financial systems. In September 2023, Ravi Menon, Chairman of the NGFS – the network of central banks, financial regulators and financial institutions for the greening of the financial system – warned: "Along with the climate crisis, the degradation of nature is an existential threat facing our planet. Addressing nature-related risks and its broader implications for the financial sector is no longer just prudent – it is an imperative".

As these risks require rigorous measurement, several frameworks have been proposed. The NGFS has published a conceptual framework for taking into account the risks associated with biodiversity loss. Target 15 of the Kunming Montreal Global Biodiversity Framework also encourages businesses and financial institutions to assess, report on and reduce the risks associated with biodiversity loss and the negative impacts they have by 2030. Lastly, the Task Force on nature-related Financial Disclosure (TNFD) has proposed a reporting framework to help businesses and financial institutions analyse and disclose these risks and impacts, recommending the use of various biodiversity metrics.

However, as the missions of PDBs focused on achieving the Sustainable Development Goals (SDGs) are very specific within financial institutions, there are few studies to help this type of institution identify the biodiversity metrics best suited to their activities.

Objectives

The main objective is to compare six biodiversity metrics to determine which are best suited to the needs of Public Development Banks. By identifying the best practices, this project aims to guide PDBs in their financing decisions, by better integrating biodiversity considerations. This harmonisation of biodiversity measurement practices will improve the environmental impact of the projects financed.

The research project also seeks to reveal the accessibility costs and the need for training within PDBs so that they can effectively integrate biodiversity considerations into their risk assessments.

This project is part of the ECOPRONAT research programme, which supports research on how to better take into account biodiversity and mainstream it into key economic sectors.

Method

Following an preliminary comparative study by The Biodiversity Consultancy, six metrics for assessing biodiversity in PDBs projects were selected: ENCORE, ABC-map, STAR, CBF, BFFI and GBS. These relevant and scientific metrics cover the main drivers of biodiversity loss.

A sample of six varied AFD projects was selected to test these metrics. The projects include initiatives in Africa, Pakistan and Mexico. The European Bank for Reconstruction and Development (EBRD) also tested the same metrics on three of its projects.

The study, conducted by Biotope and Arcadis, is being carried out in three phases:

- Launch and data collection: briefing, project validation and data collection with recommendations;

- Implementation: summary assessment, then in-depth assessment depending on the data available;

- Consolidation and reporting: analysis of results, comparison of metrics and drafting of summary report.

Results

A preliminary study proposes several protocols for the use of several metrics in order to compare their results. It also contains information that may be useful to some development banks that simply want to choose a metric and see how they can use it. With this in mind, a decision tree for choosing one of the metrics studied is proposed in Appendix 2 of this preliminary report.

Download the preliminary study

This research project aims to produce a comparative analysis detailing the advantages and limitations of the different biodiversity metrics studied. A Public Policy Dialogue provides synthetic results, a case study and specific recommendations for the integration of these metrics into PDBs financing processes.

Download the Public Policy Dialogue

The full report will be published on this page after the Biodiversity COP16 by the end of 2024. In addition, webinars and publications will be used to share the findings with a wider audience, including development and biodiversity protection stakeholders.

Download the final Research paper N°381

Contact

-

Julien CALAS

Research Officer on Biodiversity