The content of this project information sheet falls under the sole responsibility of the AFD and does not necessarily reflect the opinions of the European Union.

The content of this project information sheet falls under the sole responsibility of the AFD and does not necessarily reflect the opinions of the European Union.This project is carried out with the support of the European Union

Legal notice EU (project) The Extension of the EU-AFD Research Facility on Inequalities in partnership with Fedesarrollo and in close collaboration with the Ministry of Finances implemented the methodology of the Commitment to Equity (CEQ) to analyze the country's fiscal structure and its impact on inequalities specially after major changes caused by the Covid 19 pandemic and the fiscal reform passed at the end of 2022.

Legal notice EU (project) The Extension of the EU-AFD Research Facility on Inequalities in partnership with Fedesarrollo and in close collaboration with the Ministry of Finances implemented the methodology of the Commitment to Equity (CEQ) to analyze the country's fiscal structure and its impact on inequalities specially after major changes caused by the Covid 19 pandemic and the fiscal reform passed at the end of 2022.

Context

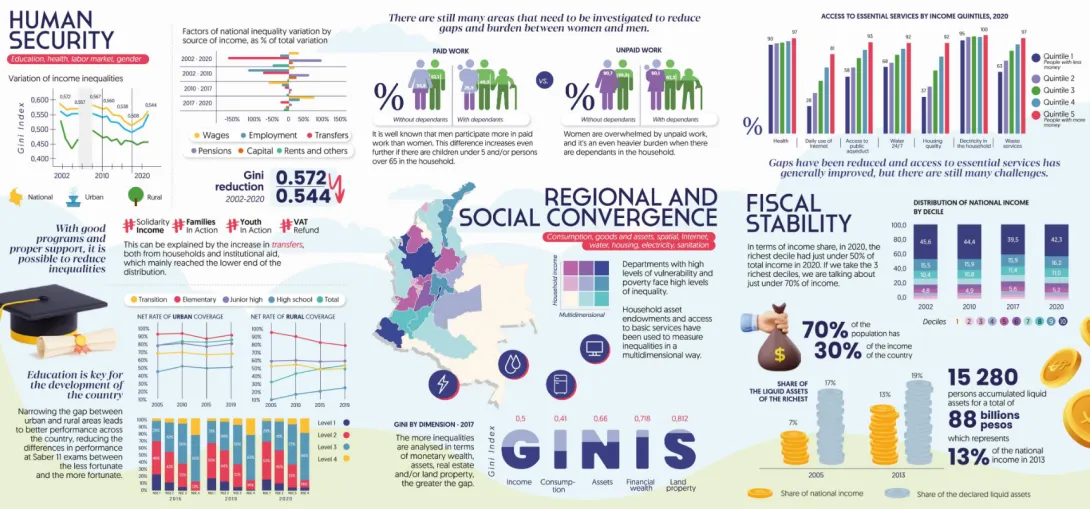

Prior to the pandemic caused by COVID - 19, Colombia had shown positive results with respect to the reduction of poverty and inequality. For example, total poverty was reduced by 6.1 percentage points between 2012 and 2018 from 40.8% to 34.7% as was extreme poverty, which went from 11.7% to 8.2%, according to official statistics. Likewise, although Colombia is among the most unequal countries in the region, it reduced its Gini index by about 0.03 units from 0.539 in 2012 to 0.508 in 2017, according to data from the National Administrative Department of Statistics (Departamento Administrativo Nacional de Estadísticas, 2021).

However, with the public health contingency, many people lost their jobs or had their incomes reduced due to pandemic containment measures that affected both aggregate supply and aggregate demand. Naturally, according to official statistics, poverty levels increased significantly and inequality rebounded to the levels of five years ago. In fact, by 2020, the country was, according to the latest ECLAC Social Panorama, the most unequal in Latin America (Economic Commission for Latin America and the Caribbean, 2021).

In this sense, the country's tax structure plays a fundamental role to the extent that direct, indirect and in-kind transfers are transformed into support for the most vulnerable households so that they can meet their basic needs and balance these inequalities to some extent. In addition, taking into account that progressivity is one of the principles of the tax system, those with higher incomes should pay higher taxes to finance social spending. In this sense, the tax reform that began to take effect in 2018 and now the Fiscal Reform adopted at the end of 2022 made some major modifications to the corresponding statute with the objective of increasing revenues.

This project is part of the Extension of the EU-AFD Research Facility on Inequalities. Coordinated by AFD and financed by the European Commission, the Extension of the RFI will contribute to the development of public policies aimed at reducing inequalities in four countries: South Africa, Mexico, Colombia and Indonesia over the period 2021-2025.

Objectives

The methodology developed by the Commitment to Equity institute (CEQ) has been used to carry out this study. The CEQ methodology allows to do a fiscal incidence analysis, that is, to analyze the redistributive impact of public policy instruments, on the tax side, as well as on the social spending side, on poverty and inequalities. In this sense, based on household surveys, it is possible to assess the redistributive capacity of taxes and transfers (whether direct or indirect) to guide public policy in this area.

The aim of the study was to identify which policies, either from the tax side or from the expense side, allow a greater impact (negative or positive) on inequalities. This then gives us, and the government, a clearer picture of the effects of the fiscal structure.

In addition, the project sought to build a tool that parameterizes the tax structure and social spending and allows making microsimulations that are useful for policy discussions. In this sense, this project sought to accompany the teams of the Ministry of Economy, providing them with a tool that allows them to carry out the necessary simulations to evaluate the impacts of different policies. The recently adopted tax reform was also analyzed through the lens of this tool.

Research findings

You will find below the research paper related to this project:

Contact

-

Anda DAVID

Economist, scientific coordinator of the EU-AFD Research Facility on Inequalities

Discover other research projects

Reducing spatial inequalities through efficient public service delivery in Colombia

Completed

2024 - 2025

Legal notice EU (project) This research project conducted by the Extension of the EU-AFD Research Facility on Inequalities in close collaboration with DANE and DNP, and in partnership with Fedesarrollo, conducted a comprehensive analysis of inequalities in Colombia through the implementation of the diagnostic on inequalities. It also aimed, together with DANE, to strengthen statistics on inequalities in the country.

Legal notice EU (project) This research project conducted by the Extension of the EU-AFD Research Facility on Inequalities in close collaboration with DANE and DNP, and in partnership with Fedesarrollo, conducted a comprehensive analysis of inequalities in Colombia through the implementation of the diagnostic on inequalities. It also aimed, together with DANE, to strengthen statistics on inequalities in the country.

Context

In Colombia, and in other countries, the objective of the Extension of the EU-AFD Research Facility on Inequalities is to provide analysis, methodologies, and statistics that allow understanding the state of inequalities in the country, the dynamics and interrelationships with the different areas, sectors, and regions of the economy. The objective is to provide robust and updated data, to provide evidence for the construction of public policies, but also to identify areas where data collection can be improved, and those where research can be deepened to better understand the context and support the construction of public policies aimed at reducing inequalities...

In Colombia, DANE has made great progress in recent years in the collection and availability of data in order to analyze and better understand the reality of the country. Several studies have been carried out with some of these data, but, for several years, there has been no comprehensive analysis of inequalities at the national level using several databases to get a complete picture of the country's situation. Since mid-2021, AFD has been working hand-in-hand with DANE and Fedesarrollo to carry out a multidimensional diagnostic on inequalities, based on an innovative reference methodology created by AFD. It provides a comprehensive view of the country's situation as it covers a wide range of aspects (health, education, incomes, etc.) all under the prism of inequalities and using different indicators and databases.

This project is framed in a context in which inequalities acquire crucial relevance in the public policy of the current government and in the agreements adopted by it within the framework of the 2030 agenda, as well as in its entry into the OECD.

This project is part of the Extension of the EU-AFD Research Facility on Inequalities. Coordinated by AFD and financed by the European Commission, the Extension of the Facility will contribute to the development of public policies aimed at reducing inequalities in four countries: South Africa, Mexico, Colombia and Indonesia over the period 2021-2025.

Objectives

The project aimed to support and strengthen the production of national statistics on inequalities, promoting exchanges and interoperability between DANE and other national and international institutions. More specifically, the main objectives were:

- To implement the methodology of the multidimensional diagnostic on inequalities, and therefore create the first national diagnostic on inequalities in Colombia. For this, AFD worked hand in hand with Fedesarrollo and in close collaboration with DANE.

- To accompany DANE's technical teams in the production, updating and improvement of statistics on inequalities based on the inequality diagnostic methodology. These data will be used to monitor over time the evolution of the indicators considered relevant, and, depending on the outcome of the data collected, to advance in analyses that integrate elements related to climate change and the environment.

- To support DANE’s technical teams in implementing new methodologies and initiatives to obtain statistics that allow a better understanding of the distribution of income of individuals and households in the country. Workshops and seminars served to share experiences and establish practices that allow high-quality data for decision-making.

Find out more about the methodology

Research findings

The research project led to the publication of the multidimensional diagnostic on inequalities in Colombia. It takes into account multiple dimensions of inequality: income distribution, consumption, labour income, household assets and services, level of wealth in land and financial assets, access to and quality of education and health, access to basic services... This document is key to understanding the gaps that exist in Colombia, and allows for evidence-based decision-making and progress towards reducing inequalities.

To go further

Contact

-

Anda DAVID

Economist, scientific coordinator of the EU-AFD Research Facility on Inequalities

For further reading on inequalities

Discover other research projects

Analysis of Colombia’s fiscal policy and public spending impact on inequalities

Completed

2022 - 2023

Reducing spatial inequalities through efficient public service delivery in Colombia

Completed

2024 - 2025

Legal notice EU (project) What have been the local stimulus effects of the South African Presidential Employment Stimulus Initiative (PES) and the national social grants program? The Extension of the EU-AFD Research Facility on Inequalities in partnership with SALDRU will seek to answer this question.

Legal notice EU (project) What have been the local stimulus effects of the South African Presidential Employment Stimulus Initiative (PES) and the national social grants program? The Extension of the EU-AFD Research Facility on Inequalities in partnership with SALDRU will seek to answer this question.

Context

The Covid-19 pandemic has forced societies around the world to make difficult trade-offs, as they try respond to the public health crisis on one hand, and to the economic and social distress arising out of it on the other. In South Africa, these combined crises have exacerbated already high levels of unemployment, deepening poverty and heightening levels of hunger and food insecurity.

To mitigate the combined health, social and economic crises stemming from the Covid pandemic, South African President Cyril Ramaphosa announced, in April 2020, a range of support measures to mitigate their impact, including emergency social protection and employment stimulus measures.

This project is part of the Extension of the EU-AFD Research Facility on Inequalities. Coordinated by AFD and financed by the European Commission, the Extension of the Facility will contribute to the development of public policies aimed at reducing inequalities in four countries: South Africa, Mexico, Colombia and Indonesia over the period 2021-2025.

Objectives

This research project aims to study the local stimulus effects of South Africa's PES and national social grants program. In order to do so, it brings together a wide range of existing and new data sources, such as shopper data provided by Shoprite Checkers and programme participant data from Harambee Youth Employment Accelerator, which are securely merged while preserving individual anonymity using local tech company Omnisient’s proprietary encryption technology.

The primary research focus will be on the multiplier effects of these two programs, that is, the effects of the programs on the economy beyond the direct impact of spending on program participants and their households.

These program-specific multiplier effects are crucial to the overall evaluation of the programs, particularly in the context of budget constraints, but are difficult to identify in a credible empirical manner given the lack of work on them in South Africa.

In studying them, this project thus has the dual objective of characterizing the spending patterns of stimulus beneficiaries and then examining how such spending is likely to stimulate economic activity in industries further up the product supply chain. Much of the analysis proposed is descriptive and extrapolative rather than causal when it comes to quantifying multiplier effects.

Thus, the overall goal of this research is to provide an incomplete but conservative and credible quantitative baseline for thinking about program-specific multipliers in South Africa, in an environment where such evidence is lacking.

Research findings

The publications and webinars related to this research project are available below.

You will find below the two research papers related to this project:

The project also organized two research conferences to present the results of the research. The replays are available below.

- SALDRU-AFD-EU Event: The stimulus effects of South Africa’s Basic Education Employment Initiative (February 7, 2024)

AFD, the EU Delegation in South Africa and SALDRU hosted a public event on the stimulus effects of the Presidential Youth Employment Initiative – Basic Education Employment Initiative (PYEI-BEEI) at the University of Cape Town.

The PYEI-BEEI programme, which targets 18-35 year-olds eligible as education assistants or general school assistants, is the largest component of South Africa’s Presidential Employment Stimulus (PES), announced in 2020 as one of the support measures against the impact of the COVID-19 pandemic.

The research was presented by Joshua Budlender (one of the project's researchers) and complemented by a presentation on the direct returns to learners in the classroom from the PES interns in the schools. Also under consideration is, as the PYEI-BEEI researchers conclude, whether other public spending (such as social grants) may have similar initial stimulus effects.

An interview with Josh Budlender is also available below:

- Research Conversations: Stimulus effects of public employment programmes (12 June 2024)

A webinar on the stimulus effects of public employment programmes with Anda David (AFD), Ihsaan Bassier (UCT-SALDRU) and Maikel Lieuw-Kie-Song (ILO) was also held.

Download the research papers

Contact

-

Anda DAVID

Economist, scientific coordinator of the EU-AFD Research Facility on Inequalities

Discover other research projects

Legal notice EU (project) Does the use of stimulus programs and social grants by beneficiaries have an impact on the South African economy? Conducted by Infusion Knowledge as part of the Extension of the EU-AFD Research Facility on Inequalities, this research project examined the purchasing habits of stimulus beneficiaries and analyzed how the new "post-stimulus" environment impacts the trade and decision-making of commercial entities and some of their customers.

Legal notice EU (project) Does the use of stimulus programs and social grants by beneficiaries have an impact on the South African economy? Conducted by Infusion Knowledge as part of the Extension of the EU-AFD Research Facility on Inequalities, this research project examined the purchasing habits of stimulus beneficiaries and analyzed how the new "post-stimulus" environment impacts the trade and decision-making of commercial entities and some of their customers.

Context

In July 2019, Infusion Knowledge Hub conducted a study on opportunities for wholesale in Stock Road in Philippi in the Western Cape Province on behalf of a large South African supermarket chain. The purpose of the study was to understand the trading environment in the informal and small business market to elicit a value-added cash and carry shopping proposition (Vawda, Prinsloo and Prinsloo, 2019).

In June 2022, as part of a research program launched by the Presidency of South Africa and Agence Française de Développement, funded by the European Union, Infusion Knowledge Hub replicated the study to determine whether there are shifts in purchasing behaviour amongst the informal and small traders that participated in the 2019 research. In doing so, the study aimed to provide granular data on shifts in the informal and small traders’ operating environment around Stock Road in Philippi between July 2019 and June 2022. In addition, the research investigated the spending patterns of 30 Social Relief Distress (SRD) grant recipients and 31 Basic Education Employment Initiative (BEEI) participants.

This project is part of the Extension of the EU-AFD Research Facility on Inequalities. Coordinated by AFD and financed by the European Commission, the Extension of the Facility will contribute to the development of public policies aimed at reducing inequalities in four countries: South Africa, Mexico, Colombia and Indonesia over the period 2021-2025.

Objectives

This new research project aimed to contribute to the body of knowledge on the impact of social protection and employment stimulus measures on the formal and informal economies.

Two studies analysing the local effects of the South African Presidential Employment Stimulus Initiative (PES) and the national social grants programme were produced:

- One study, presented in note form, that builds on Infusion's long-standing relationship with Shoprite to allow SALDRU to use Shoprite's customer data to explore the shopping habits of stimulus beneficiaries. The focus was on unpacking purchasing data related to beneficiaries who receive the Distressed Social Relief Grant and those who are part of the school assistants programme managed by the Department of Basic Education (DBE).

- A research paper that details through descriptive and inferential statistical analysis the transfer to a mobile application, called NECTA, of a landmark study by Infusion and Shoprite conducted among informal vendors and "Spaza" stores in Philippi. This data provides an overview of what has been happening in these businesses since July 2019 (the date of the initial project), as well as an opportunity to see how the new "post-stimulus" environment is impacting the trade and decision-making of these business entities as well as some of their customers.

Research findings

You will find below the research paper related to this project:

Contact

-

Anda DAVID

Economist, scientific coordinator of the EU-AFD Research Facility on Inequalities

Discover other research projects

Redesigning the South African “Social Relief Distress” grant program for higher impact

Completed

2023 - 2023

Legal notice EU (project) What have been the impacts of the Covid-19 national stimulus package's social assistance on local economies and informal sector workers in South Africa? The Extension of the EU-AFD Research Facility on Inequalities program sought to answer this in collaboration with CSDA.

Legal notice EU (project) What have been the impacts of the Covid-19 national stimulus package's social assistance on local economies and informal sector workers in South Africa? The Extension of the EU-AFD Research Facility on Inequalities program sought to answer this in collaboration with CSDA.

Context

In South Africa, informal work is a feature of the labor market - one in six South African workers is employed in the informal sector. During the pandemic, millions of workers without legal or social protection were disproportionately affected by the negative impacts of measures to prevent the spread of Covid-19 (loss of jobs, hours of work and income...). As a "forgotten" sector in many ways, it should not be forgotten that the informal sector provides livelihoods, employment, and income for millions of workers and business owners, and contributes significantly to the country's Gross Domestic Product (GDP).

In response to the social and economic effects of the pandemic on vulnerable groups, the South African government has further developed its social protection system. As part of the social assistance component of the Covid-19 stimulus package, it introduced a new Social Relief of Distress (SRD) grant in April 2020. This social assistance grant is for the first time targeted at many informal workers on the basis of their employment status.

While the positive links between the subsidy and economic activity had already been studied, as well as the limits to this interaction, it remained to be understood whether and how the SRD had been used by informal workers and what economic effects had been generated. This project was conducted by CSDA as part of a larger program to analyze various components of the South African government's Covid and recovery stimulus package.

This project is part of the Extension of the EU-AFD Research Facility on Inequalities. Coordinated by AFD and financed by the European Commission, the Extension of the Facility will contribute to the development of public policies aimed at reducing inequalities in four countries: South Africa, Mexico, Colombia and Indonesia over the period 2021-2025.

Objectives

To better understand the effects of the Covid-19 and recovery public policy stimulus on reducing inequality, this study qualitatively analyzed the interactions and impacts of the SRD (as well as other subsidies, and the stimulus package more broadly) on local economies.

In particular, it focused on the experiences of women and men traders in the informal sector, who represent a significant proportion of informal sector workers. Through the data collected, differentiated patterns by gender, location, and level of the informal worker in his or her work organization have also been revealed.

Research findings

You will find below the research paper related to this project:

Contact

-

Anda DAVID

Economist, scientific coordinator of the EU-AFD Research Facility on Inequalities

Discover other research projects

Evaluation of local stimulus effects in South Africa: Jobs and grants programmes

Completed

2022 - 2023

Legal notice EU (project) How do inequalities influence biological and social outcomes in MPAs in Indonesia? The Extension of the EU-AFD Research Facility on Inequalities program sought to answer this question in collaboration with SMERU to integrate inequality assessments and indicators into existing MPA policies in the country at all levels of governance.

Legal notice EU (project) How do inequalities influence biological and social outcomes in MPAs in Indonesia? The Extension of the EU-AFD Research Facility on Inequalities program sought to answer this question in collaboration with SMERU to integrate inequality assessments and indicators into existing MPA policies in the country at all levels of governance.

Context

MPAs are often associated with high poverty, being by design targeted at relatively untouched areas with low economic potential. Establishing an MPA can thus create a financial and social burden on resource-dependent communities, even if the benefits of doing so would bring higher yields or revenue in the future. Some stakeholders may benefit greatly from commercial activities (e.g., tourism, sale of higher-value products), while at the same time others are left out of the management processes, sometimes even those having most at stake.

Because MPAs will most likely affect user groups disproportionately, inequality issues among stakeholders can easily arise. Some aspects of MPA design, implementation, and management may contribute to positive ecological and well-being outcomes, while others will require tradeoffs. This coexistence of both co-benefits and trade-offs among stakeholder groups leads to tricky questions of equity, justice, and power in the design, implementation, and management of MPAs. There is a general lack of knowledge regarding how inequalities influence MPA outcomes.

In brief, MPAs are a driver of inequalities in communities that rely heavily on marine resources, and a powerful tool to help reduce them. While being an important aspect of the well-being of the people involved and of the success of MPAs, inequality assessments and metrics are currently largely absent in the design, implementation and management of MPAs. This research project aimed at a deeper understanding of the inequality dynamics in MPAs in Indonesia, drawing upon existing data and specific case studies. It helped us gain better knowledge of how inequalities influence biological and social outcomes in MPAs, and brought insights on how to integrate inequality assessments and indicators in existing MPA policies in the country, at every level of governance.

This project is part of the Extension of the EU-AFD Research Facility on Inequalities. Coordinated by AFD and financed by the European Commission, the Extension of the Facility contributes to the development of public policies aimed at reducing inequalities in four countries: South Africa, Mexico, Colombia and Indonesia over the period 2021-2025.

Objectives & results

This project first went through a scoping phase which enabled to better understand the role of MPAs and its link to inequalities. It then aimed to develop a framework for analyzing inequalities and their dynamics in MPAs in Indonesia, and a toolbox for mainstreaming inequalities in the design, implementation and management of MPAs. It has also fed into the policy dialogue conducted by the EU and AFD on marine resource management and environmental protection.

This project therefore resulted in:

- A working paper summarizing the current knowledge on marine protected areas and inequalities in Indonesia (carried out by LPEM).

- An in-depth research project on the links between inequality reductions and the management of marine protected areas, including cases studies of three MPAs (performed by the SMERU Institute).

- Training and capacity building activities with practitioners and MPA managers on the inclusion of inequalities in MPA management practices.

Research findings

You will find below the different publications related to this project :

- The benefits of Marine Protected Areas in fighting inequality and fostering environmental sustainability in Indonesia

- Balancing conservation and community welfare: Enhancing the management of Marine Protected Areas in Indonesia

- Can social inclusion benefit ecosystems?

Watch the replay of the "Research Conversations" webinar on this topic (July 2023):

Contacts

-

Oskar LECUYER

Research Officer, Environmental Economist

Other research projects supported by the Extension in Indonesia

Legal notice EU (project) How to effectively reduce inequality in Indonesia? To answer this question, the Extension of the EU-AFD Research Facility on Inequalities is working with the local research center LPEM and the national statistical office BPS to produce a diagnosis that is essential to guide policy interventions towards reducing inequalities.

Legal notice EU (project) How to effectively reduce inequality in Indonesia? To answer this question, the Extension of the EU-AFD Research Facility on Inequalities is working with the local research center LPEM and the national statistical office BPS to produce a diagnosis that is essential to guide policy interventions towards reducing inequalities.

Context

In Indonesia, poverty has been declined since 2006 from 17.75% to 9.41% in 2019 due to strong economic growth and other poverty reduction efforts. The inequality, however, remains considerably high. Since 2010, Indonesia’s Gini ratio remains above 0.38. The poverty and inequality situation has been worsen post-pandemic. Indonesia’s headcount poverty rate back to double digit, 10.14% in 2021, while the Gini ratio climbed to 0.384, its highest rate since 2018. While focus on economic inequality is important, the picture of inequality in Indonesia should be assessed through a multi-dimensional aspect, not limited to households income or expenditure.

Indonesia is a fourth most-populous and also the largest archipelagic country in the world. It makes any policy context should be assessed carefully throughout population groups, income class, and geographical location due to the difference in the provision of public infrastructure and policy efforts within the country. As such, a comprehensive inequality diagnostic report is needed to assess overall condition of inequality in Indonesia not only using monetary indicator (income or expenditure), but also social assets, in terms of access to education, health, water and sanitation, employment, and other basic infrastructures needed for households.

The Extension of the Research Facility on Inequalities will cooperate with leading research center, LPEM FEB UI, and national statistical office, BPS, to conduct comprehensive inequality assessment and produce an inequality diagnostic report as the basis for launching a national dialogue about inequality and stimulate policy interventions to overcome inequality.

This project is part of the Extension of the EU-AFD Research Facility on Inequalities . Coordinated by AFD and financed by the European Commission, the Extension of the Facility will contribute to the development of public policies aimed at reducing inequalities in four countries: South Africa, Mexico, Colombia and Indonesia over the period 2021-2025.

Objectives

The objectives of the Inequality Diagnostic Research in Indonesia are:

- to produce a working paper which will consolidate data and resources (papers) around inequality issues to profile the prevailing situation of inequality in Indonesia.

- to conduct capacity building activities for national research center and the national statistical office in performing data analysis for the Inequality Diagnostic Research Report.

- to introduce specific tools for multidimensional inequalities diagnostic in Indonesia.

This research has led to a comprehensive Inequality Diagnostic Research Report in Indonesia and contributes to public debate and discussion on Inequality in Indonesia. Indeed, this project performed a thorough analysis of multi-dimensional aspect of inequality in Indonesia and a comprehensive breakdown based on income groups, geographical locations, and gender. It also includes analysis of prior policies that have been taken by the government to reduce inequality and how it performs overtime. The output of this research will help government to identify priorities and policy options in order to further reduce them.

Research findings

You will find below the research publications related to this project:

Read the press release

Contacts

-

Oskar LECUYER

Research Officer, Environmental Economist

Other research projects supported by the Extension in Indonesia

Harnessing the benefits of inequalities reduction in marine protected areas in Indonesia

Completed

2022 - 2023

Legal notice EU (project) The fear that cash transfer programs (or social grants) can discourage labor market participation is common among policymakers locally and around the world, including in South Africa. To refute or confirm this fear, the Extension of the EU-AFD Research Facility on Inequalities worked with the Development Policy Research Unit (DPRU) of the University of Cape Town to analyze the impacts of the Covid-19 grant on labor market recovery and investment in productive activity in South Africa.

Legal notice EU (project) The fear that cash transfer programs (or social grants) can discourage labor market participation is common among policymakers locally and around the world, including in South Africa. To refute or confirm this fear, the Extension of the EU-AFD Research Facility on Inequalities worked with the Development Policy Research Unit (DPRU) of the University of Cape Town to analyze the impacts of the Covid-19 grant on labor market recovery and investment in productive activity in South Africa.

Context

In South Africa, the social grant system is relatively comprehensive in scope, directly benefiting one in three individuals, and mainly empowering the most vulnerable such as children, the elderly and people with disabilities from poor households. Despite the progressiveness of this system, there remains a lack of assistance to the unemployed, who are presumed to be able to support themselves through the labor market (Ferguson, 2015). However, such a view overlooks the widespread and structural nature of unemployment in South Africa, where over 70% of the unemployed have been unemployed for more than a year.

In this light, the expansion of the country's social grant system in response to the Covid-19 pandemic played an important role in filling this gap. On the margins of the system, a special Covid-19 grant of R350 was introduced to support this previously unreached and important group of unemployed adults. With one of the highest official unemployment rates in the world (32.6 percent in the first quarter of 2021), the grant was an important form of support for millions of vulnerable adults and was the first to use an explicit labor market eligibility criterion that could be considered a "labor market vulnerability transfer."

This project is part of the Extension of the EU-AFD Research Facility on Inequalities. Coordinated by AFD and financed by the European Commission, the Extension of the Facility will contribute to the development of public policies aimed at reducing inequalities in four countries: South Africa, Mexico, Colombia and Indonesia over the period 2021-2025.

Objectives

Conducted by the UCT-DPRU team, the objective of this research project was to quantitatively study whether the Covid-19 grant acted as a source of labor market recovery by leading to increased investment in productive labor market activities.

To do this, the research aimed to provide a detailed and quantitative descriptive analysis of transitions in labor market outcomes among Covid-19 grant recipients (measuring whether individuals moved from vulnerable to more productive activities, for example), as well as an analysis of the correlation between grant receipt and labor market outcomes. Finally, it estimated the causal effects of subsidy receipt on a range of productive labor market activities.

Method

The analysis exploited representative survey data collected during the pandemic in South Africa (from the National Income Dynamics Study: Coronavirus Rapid Mobile Survey, NIDS-CRAM) to answer the following cross-sectional and longitudinal questions about the role of the subsidy:

- What is the correlational relationship between receipt and job-seeking behavior, labor market participation, and the probability of finding a job ?

- What is the correlation between receipt of the subsidy and the transition from a relatively unproductive labor market state to a more productive state over time?

- Does this relationship vary across different groups and subgroups of recipients?

Research findings

You will find below the research paper related to this project:

Contact

-

Anda DAVID

Economist, scientific coordinator of the EU-AFD Research Facility on Inequalities